of experience

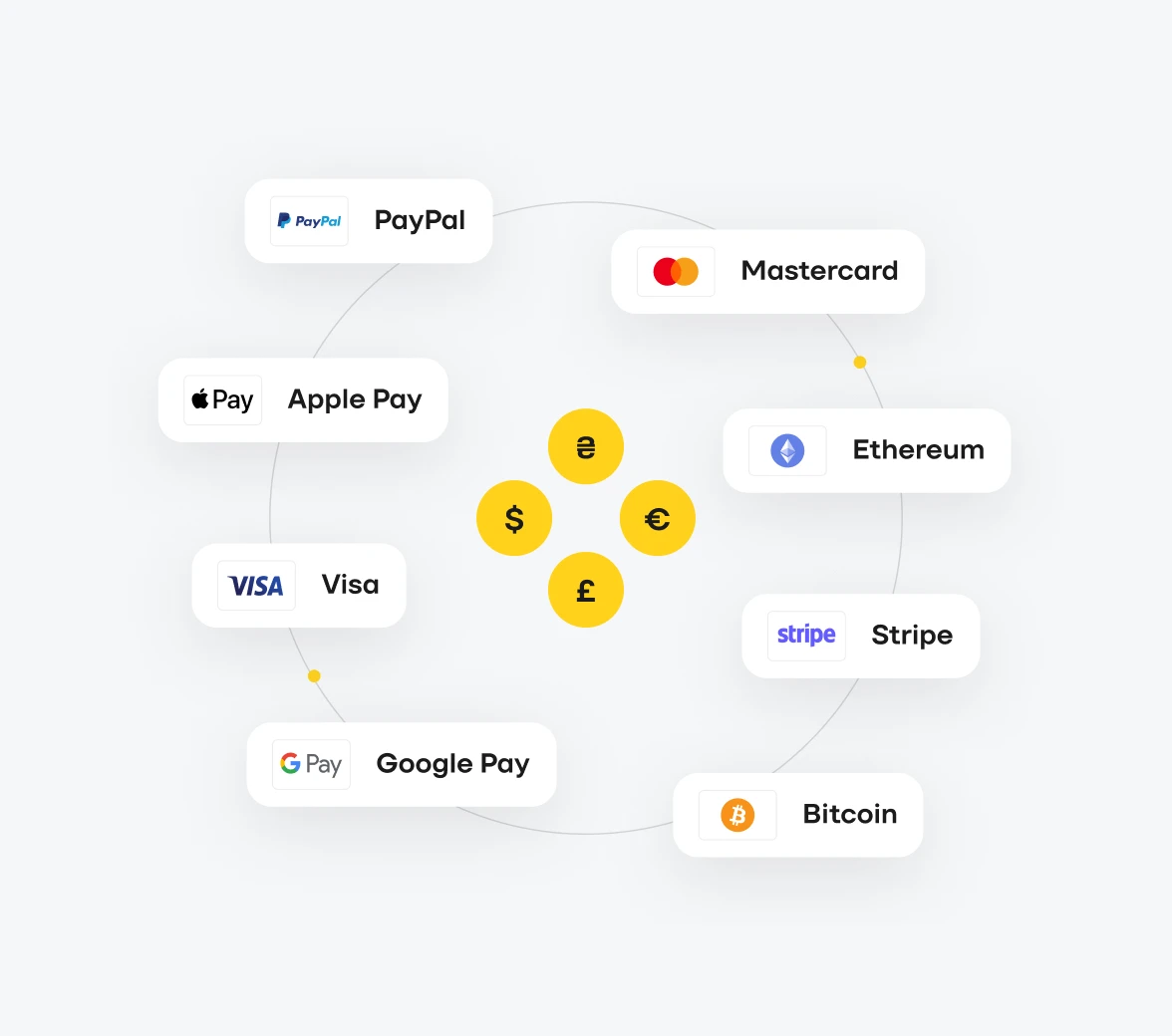

High-conversion payment

methods

for online businesses

Cards and alternative methods, backed by features for higher approval rates and robust anti-fraud protection.

of experience

Partner for Binance

support

SettlePay

payment solutions

SettlePay

case studies

From zero to fully integrated: payment solutions in Mexico

Challenges

The ability for users to make deposits and withdrawals in Mexico.

Services

The payment methods market was researched, negotiations were held, and popular payment methods covering most online payments in Mexico were integrated. A backup and cascading system was built to ensure the stable functioning of the method in this region.

Results

The solution enabled integration of the payment method without major modifications on the client’s side, offering customization of the payment form to boost conversion rates. A stable payment solution system was developed, allowing payouts to be processed via API or through the CRM system, with expected conversion rates for both deposits and payouts achieved.

Increasing conversion by 19% through data-driven segmentation

Challenges

The merchant wanted to increase the conversion rate for the payment method by having statistics on it. We had to segment a traffic distribution among users.

Services

We released the integration with additional providers to increase conversion. Researched user behavior patterns, and analyzed the likelihood of paying with different payment methods. Then set up cascading and routing based on the gathered statistics.

Results

Conversion for selected payment methods increased by 19%.

Improving payment success across devices in LATAM

Challenges

More than 22% of users in LATAM faced difficulties when filling out payment forms. The merchant’s existing design was focused mostly on modern mobile and desktop devices ignoring old formats, which led to a drop in conversion rates.

Services

We conducted a detailed analysis of user behavior across different mobile and desktop devices. Developed a responsive design that automatically adjusts to the device’s screen, simplified navigation, and reduced the number of fields for users. We also tested the design on various devices to ensure a smooth user experience on both mobile and desktop.

Results

This increased payment conversions on devices by 23%, reduced the number of payment process failures, and shortened the average payment time for customers.

Optimizing payment processes in India

Challenges

In India, different payment methods are required for transactions below 100,000 rupees and those above, with regulators mandating the submission of varying parameters for each.

Services

We analyzed the user flow and integrated additional providers to ensure smoother operation of the payment method. New payment forms were developed, which, through a single integration, fully met the merchant’s needs for different directions and amounts.

Results

The solution increased conversion by 12%, reduced transaction processing time, and improved user satisfaction.

Explore our latest

news & insights

FAQ

Got questions? We've got answers. Explore our comprehensive FAQ section to find solutions to common inquiries.

How to start cooperation with SettlePay?

Please fill out the form and our team will contact you.

What countries do you operate in?

We have various solutions for LATAM, Europe, CIS, Asia, and Africa.

What is Binance Pay and why is it needed?

Binance Pay provides secure, fast, and low-fee cryptocurrency transactions for clients with a Binance account.

Does SettlePay have a referral program for partners?

You can become our partner by integrating our solutions on your platform, or cooperate as a referral.

Contact us here for details.

How does SettlePay ensure the security of users financial transactions?

SettlePay uses advanced encryption technologies and meets the PCI DSS standard to ensure the security of financial transactions and the confidentiality of user data.

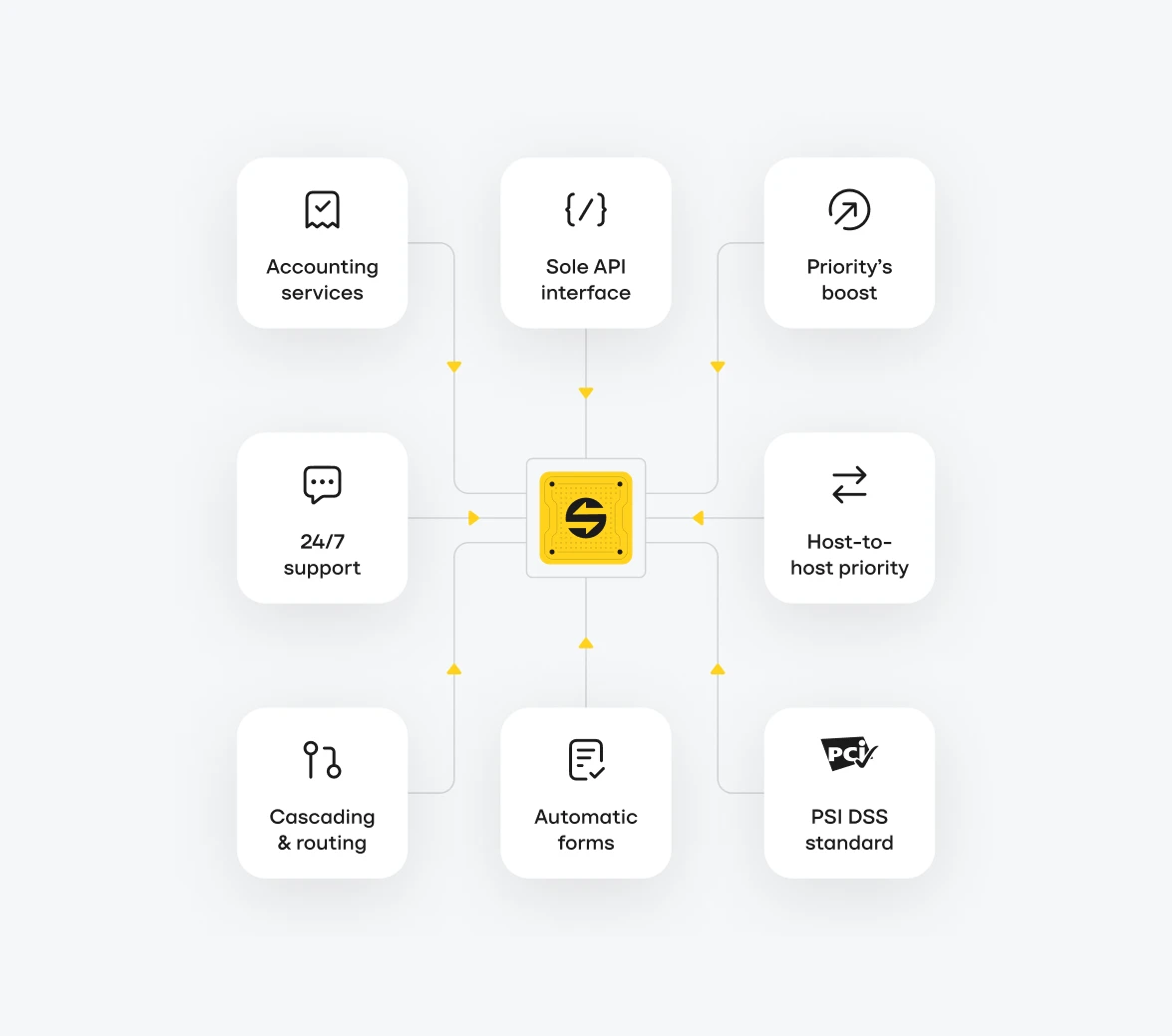

What solutions do you implement to improve the conversion rate for merchants?

We use our own cascading and smart routing processes to ensure the speed and success of the transactions.